Factor investing is a strategy that aims to improve portfolio performance by targeting specific drivers of return, known as “factors.” These factors—such as value, momentum, size, quality, and volatility—have been shown through research to influence asset returns over the long term. Unlike traditional investing, which often focuses on individual securities or market timing, factor investing relies on systematic, data-driven strategies to identify factors that provide a persistent edge in the market.

In this post, we’ll explore what factor investing is, the most commonly used factors, and how investors can harness them to build better, more resilient portfolios.

What is Factor Investing?

Factor investing is a strategy that involves selecting securities based on their exposure to certain risk factors that have historically delivered higher returns over time. The goal is to focus on characteristics or “styles” of stocks that are expected to outperform based on economic principles and empirical data.

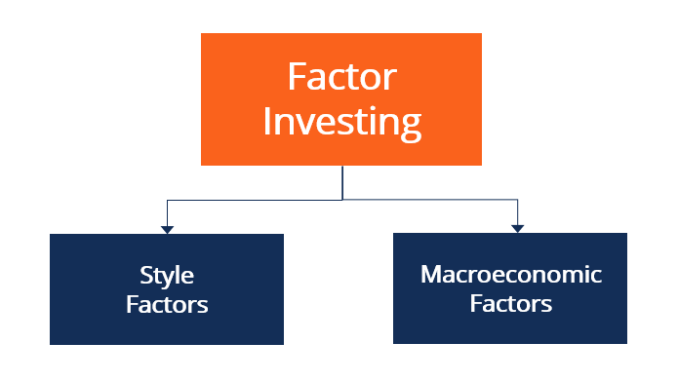

Factors can be categorized into two broad types:

- Style Factors: These are related to the characteristics of the asset, such as growth, value, or size.

- Risk Factors: These are tied to the broader market dynamics, such as volatility, liquidity, and market sensitivity.

By investing in factors that have historically delivered outperformance, investors can potentially enhance their returns while managing risk.

The Core Factors in Factor Investing

Factor investing uses multiple factors to design portfolios that are expected to outperform in the long run. The most common factors used in this strategy include:

1. Value Factor

The value factor targets stocks that appear undervalued relative to their intrinsic worth. This could be based on metrics like price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, or dividend yields. Value stocks are often those that the market has undervalued due to temporary setbacks or negative sentiment, presenting opportunities for growth as the market corrects its mispricing.

- Example: Stocks of companies with low P/E ratios or high dividend yields relative to peers.

2. Momentum Factor

Momentum investing involves focusing on stocks that have recently outperformed the market and are expected to continue their trend. The momentum factor is grounded in the belief that stocks that have performed well in the past tend to continue performing well in the near term, driven by market psychology, trends, and investor behavior.

- Example: Investing in stocks that have seen strong price growth over the last 6 to 12 months.

3. Size Factor

The size factor involves investing in small-cap stocks (those with a smaller market capitalization) versus large-cap stocks (larger companies). Historically, small-cap stocks have outperformed large-cap stocks over the long term, largely due to their higher growth potential and ability to capitalize on market inefficiencies.

- Example: Targeting stocks of companies with market capitalizations under $2 billion.

4. Quality Factor

The quality factor focuses on stocks of companies with strong fundamentals, including high return on equity (ROE), stable earnings growth, low debt, and efficient use of capital. High-quality companies are typically more resilient during market downturns and can offer steadier long-term returns.

- Example: Companies with consistent profit margins, low debt levels, and strong management teams.

5. Low Volatility Factor

The low volatility factor seeks stocks with lower price fluctuations. These stocks tend to be more stable, offering lower risk compared to the broader market. Investors often turn to low-volatility stocks during periods of market turbulence, as they tend to provide more predictable returns and lower downside risk.

- Example: Stocks of companies in non-cyclical industries like utilities, healthcare, and consumer staples.

6. Dividend Yield Factor

The dividend yield factor focuses on stocks that pay a higher dividend than others in the market. Dividend-paying stocks are often seen as more stable, providing income in addition to potential capital appreciation. Investors seeking consistent income or a hedge against market volatility may favor this factor.

- Example: Stocks with dividend yields higher than the market average, often seen in sectors like utilities, telecoms, or real estate.

How Factor Investing Works

Factor investing is typically implemented using one of two approaches:

- Single-Factor Investing: Involves focusing on one factor at a time, such as value or momentum. Investors pick stocks based on that single factor, expecting that it will drive superior returns.

- Multi-Factor Investing: Combines multiple factors in a single strategy to enhance diversification and reduce risk. By balancing factors such as value, momentum, and quality, investors aim to achieve a more robust and well-rounded portfolio.

For example, a multi-factor portfolio might include stocks with both strong momentum and value characteristics, while also targeting low-volatility stocks for added risk control. The combination of factors helps reduce the risk that any single factor might underperform at any given time.

Benefits of Factor Investing

1. Enhanced Returns

Factor investing aims to deliver better-than-market returns by focusing on factors that have historically outperformed over time. By targeting well-researched risk factors, investors can potentially achieve superior returns relative to traditional market-cap-weighted strategies.

2. Risk Management

By using factors that are less correlated with each other (like low-volatility and quality), investors can build portfolios that are better diversified. This diversification helps to manage risk and reduce the impact of market volatility on overall portfolio performance.

3. Customization and Flexibility

Factor investing offers a high degree of flexibility. Investors can choose to focus on one or multiple factors depending on their individual goals, risk tolerance, and investment horizon. Factor-based strategies can also be tailored to suit different market conditions and personal preferences.

4. Transparency and Efficiency

Unlike actively managed strategies that rely on the discretion of fund managers, factor investing is largely rule-based and data-driven. This transparency helps investors understand exactly why a particular stock is included in a portfolio. Additionally, factor-based strategies are often more cost-effective due to their passive, systematic approach.

5. Behavioral Bias Mitigation

Factor investing can help mitigate some of the common behavioral biases that often influence traditional investing, such as overconfidence, loss aversion, and herd behavior. Since factor investing is based on empirical data and systematic rules, it reduces the emotional decision-making that often leads to suboptimal outcomes.

How to Implement Factor Investing in Your Portfolio

1. Determine Your Investment Goals and Risk Tolerance

Before diving into factor investing, assess your financial goals and risk profile. Are you looking for long-term growth, or are you focused on stability and income generation? Your answers will help guide which factors to prioritize—whether value, momentum, or low volatility.

2. Select the Right Factors for Your Strategy

Based on your objectives, choose the factors that align with your investment philosophy. You may decide to focus on just one factor, such as momentum, or combine multiple factors to diversify risk. For example, a growth-oriented investor may favor momentum and quality, while someone focused on income may prioritize value and dividend yield.

3. Diversify Across Multiple Factors

One of the key advantages of factor investing is its flexibility in combining different factors. By diversifying across multiple factors, you reduce the risk associated with any one factor underperforming. Multi-factor investing tends to produce more stable returns and is less reliant on a single market trend.

4. Use Factor ETFs and Mutual Funds

If you’re interested in implementing factor investing but lack the time or expertise to pick individual stocks, factor-based exchange-traded funds (ETFs) and mutual funds are an excellent option. These funds are designed to track specific factors, such as value, momentum, or quality, and provide instant diversification within that factor.

5. Monitor and Rebalance Your Portfolio

Factor investing requires ongoing monitoring and occasional rebalancing to maintain the desired factor exposures. Market conditions change, and the performance of certain factors can fluctuate over time. Rebalancing ensures that your portfolio remains aligned with your investment strategy and goals.

Risks and Considerations of Factor Investing

1. Factor Cyclicality

While factors like value and momentum have delivered strong returns historically, they can experience periods of underperformance. For instance, value stocks may lag growth stocks during strong bull markets. Being aware of the cyclicality of certain factors is important when implementing a factor-based strategy.

2. Complexity

Factor investing requires a solid understanding of how different factors work and how they interact with market dynamics. A strategy that combines multiple factors can be complex and require continuous monitoring. If you’re unsure, seeking professional advice or investing in factor-based ETFs may be a good option.

3. Tracking Error

Factor-based strategies, especially those that focus on niche factors or small-cap stocks, may deviate significantly from market indices, resulting in tracking error. While this can offer outperformance, it also means that the performance may not always mirror the broader market.

Conclusion: The Power of Factor Investing

Factor investing offers a systematic, data-driven approach to portfolio construction that focuses on the key drivers of returns. By investing in specific factors like value, momentum, or quality, investors can potentially enhance returns, manage risks, and build more resilient portfolios.

While factor investing can improve long-term performance, it requires careful planning, diversification, and an understanding of how different factors behave across various market cycles. By combining factors that align with your financial goals and risk tolerance, you can harness the power of factor investing to achieve more efficient and sustainable wealth creation.

Leave a Reply